Transform Your Look with Blackpink-Inspired Makeup

Unlocking the Beauty Secrets of Blackpink Makeup

Introduction

When it comes to K-pop icons, few groups shine as brightly as Blackpink. Renowned not only for their music but also for their impeccable style, Blackpink members serve as inspirations for fans worldwide. One aspect of their allure that has captivated fans is their stunning makeup looks. In this article, we delve into the secrets behind Blackpink makeup, exploring techniques, products, and tips to help you achieve that signature Blackpink glam.

The Iconic Blackpink Look

At the heart of Blackpink makeup lies a blend of elegance, sophistication, and trend-setting style. Each member brings her unique flair to the group’s overall aesthetic, but there are common elements that define the Blackpink look. From flawless skin to bold eye makeup and luscious lips, Blackpink’s beauty game is always on point.

Mastering Flawless Skin

The first step to achieving the Blackpink glow is flawless skin. Blackpink members are often seen with radiant complexions that appear smooth and blemish-free. To achieve this look, focus on skincare. Cleansing, moisturizing, and using sunscreen are essential steps to maintain healthy skin. Additionally, incorporating products like BB creams or lightweight foundations can help create a flawless base for makeup application.

Eyes That Mesmerize

One of the most striking features of Blackpink makeup is the emphasis on the eyes. Whether it’s a sultry smokey eye or a playful pop of color, Blackpink members know how to make their eyes pop. To recreate their mesmerizing gaze, invest in quality eyeshadows and eyeliners. Experiment with different techniques to find what works best for your eye shape, whether it’s winged liner, smoked-out shadow, or glitter accents.

Achieving the Perfect Pout

No Blackpink makeup look is complete without the perfect pout. Lips are often adorned with vibrant hues that add a pop of color to the overall aesthetic. To achieve luscious lips like Blackpink, start by exfoliating to remove any dry, flaky skin. Then, apply a lip primer to smooth the surface and enhance the longevity of your lip color. Finish with a bold lipstick or lip tint in shades that complement your skin tone.

Blackpink-Inspired Makeup Tips

Now that we’ve dissected the key elements of Blackpink makeup, let’s dive into some practical tips to help you achieve the look. Firstly, don’t be afraid to experiment with color. Blackpink is known for pushing boundaries and embracing bold hues, so don’t shy away from vibrant eyeshadows or statement lipsticks. Additionally, practice makes perfect. Take the time to hone your makeup skills through trial and error, and don’t be discouraged if you don’t get it right the first time. Finally, have fun with it! Makeup is a form of self-expression, so don’t be afraid to let your personality shine through.

Conclusion

With the rise of K-pop culture, Blackpink has emerged as a global phenomenon, captivating audiences with their music, style, and beauty. Their signature makeup looks serve as inspiration for fans worldwide, showcasing the transformative power of cosmetics. By unlocking the secrets behind Blackpink makeup, you too can achieve that coveted Blackpink glow and unleash your inner K-pop star. Read more about blackpink makeup

Fashion, Power, and Deception The Gucci Chronicles

The Rise and Fall of the Gucci Dynasty

Unraveling the Gucci Legacy

The Gucci brand is synonymous with luxury, elegance, and sophistication. However, behind the glamorous façade lies a story of intrigue, betrayal, and tragedy. The Gucci family, once revered as fashion royalty, has been embroiled in scandals that have rocked the fashion world to its core.

The Early Days: Building an Empire

Founded in 1921 by Guccio Gucci in Florence, Italy, the House of Gucci started as a modest leather goods company. Gucci’s commitment to craftsmanship and quality quickly earned the brand a loyal following among the elite. Over the decades, the brand expanded its offerings to include clothing, accessories, and fragrances, solidifying its status as a global fashion powerhouse.

The Gucci Family Feud

Despite its success, the Gucci family was plagued by internal strife and power struggles. Infighting among family members became increasingly common as control of the company shifted between descendants. The rivalry between Aldo Gucci and his son Paolo reached a boiling point, resulting in legal battles and bitter disputes that tarnished the Gucci name.

Betrayal and Scandal

The downfall of the Gucci empire came with a series of shocking scandals that rocked the fashion world. Maurizio Gucci, the grandson of Guccio Gucci and former head of the company, was murdered in 1995 by a hitman hired by his ex-wife, Patrizia Reggiani. The scandal sent shockwaves through the industry and exposed the dark underbelly of greed and betrayal lurking beneath the surface of the Gucci dynasty.

Legal Battles and Legacy

In the aftermath of Maurizio’s murder, the Gucci family was thrust into the spotlight once again as the case unfolded in court. Patrizia Reggiani was convicted of orchestrating her ex-husband’s murder and sentenced to 26 years in prison, though her sentence was later reduced. The trial laid bare the dysfunctional dynamics within the Gucci family and tarnished the brand’s once-untarnished reputation.

Gucci Today: A Legacy Reimagined

Despite its tumultuous past, the Gucci brand has managed to rebound under new leadership. Creative director Alessandro Michele has revitalized the brand with his bold and eclectic designs, drawing inspiration from Gucci’s rich heritage while pushing the boundaries of fashion. Today, Gucci continues to captivate audiences around the world with its innovative collections and iconic imagery, proving that even the most storied of brands can rise from the ashes of scandal and reinvent itself for a new era. Read more about house of gucci true story

Embracing Authenticity Belle Delphine’s Makeup-Free Face

Belle Delphine’s Makeup-Free Revelation: Embracing Authenticity

Belle Delphine: Beyond the Glamour

In a world where social media is often saturated with filtered images and carefully curated personas, the recent revelation of Belle Delphine without makeup has sparked conversations about authenticity and beauty standards. Known for her vibrant and eccentric online presence, Belle Delphine has built a massive following by embracing a unique blend of humor, gaming, and cosplay. However, her decision to showcase her makeup-free face sheds light on the pressures of maintaining an image in the digital age.

The Unveiling: Belle Delphine’s No Makeup Look

For years, Belle Delphine has captivated audiences with her colorful makeup, elaborate costumes, and playful persona. Her carefully crafted online identity has garnered millions of followers across various platforms, with fans eagerly anticipating each new post or video. Yet, behind the layers of makeup and quirky props lies a young woman who, like many others, grapples with self-image and authenticity.

Authenticity in the Spotlight

The decision to reveal her makeup-free face was undoubtedly a bold move for Belle Delphine. In an industry where perfection is often prized above all else, showing vulnerability can be seen as a risk. However, by peeling back the layers of her carefully constructed persona, Belle Delphine invites her audience to see her as she truly is – flaws and all. In doing so, she challenges the notion that beauty is synonymous with perfection, reminding us that authenticity is far more compelling than any facade.

The Power of Vulnerability

Belle Delphine’s makeup-free revelation serves as a powerful reminder of the importance of vulnerability in a world that often values surface-level perfection. By embracing her natural beauty, she sends a message of self-acceptance and empowerment to her followers, encouraging them to do the same. In a society that constantly bombards us with unrealistic beauty standards, Belle Delphine’s willingness to show her unfiltered self is a refreshing change of pace.

Breaking Down Barriers

In many ways, Belle Delphine’s decision to go makeup-free represents a breaking down of barriers – both literal and metaphorical. By stepping away from the makeup chair and embracing her natural appearance, she challenges traditional notions of beauty and encourages others to do the same. In an age where social media often perpetuates unrealistic ideals, Belle Delphine’s authenticity serves as a beacon of hope for those who may feel pressured to conform.

The Journey to Self-Acceptance

Like many individuals, Belle Delphine’s journey to self-acceptance has been a complex and ongoing process. In a world that constantly scrutinizes our every flaw, learning to love ourselves can be a radical act of defiance. By showcasing her makeup-free face to the world, Belle Delphine reminds us that true beauty lies not in perfection, but in embracing our authentic selves – flaws and all.

Conclusion

Belle Delphine’s makeup-free revelation is more than just a glimpse behind the curtain of her online persona; it’s a powerful statement about the importance of authenticity in an image-obsessed world. By embracing her natural beauty, she challenges societal norms and encourages others to do the same. In doing so, she reminds us that true beauty is not about conforming to unrealistic standards, but about embracing who we are – imperfections and all. Read more about belle delphine no makeup

Bella Hadid’s Body The Ultimate Fitness Inspiration

Unlocking the Fitness Secrets of Bella Hadid

Bella Hadid’s Fitness Journey Unveiled

Bella Hadid, the supermodel sensation, has captivated audiences not only with her striking beauty but also with her enviable physique. Behind the glitz and glamour of the fashion world lies a story of dedication and hard work, as Bella’s journey to physical fitness is nothing short of inspiring.

The Power of Consistency

Consistency is the cornerstone of Bella Hadid’s fitness regimen. She doesn’t believe in quick fixes or shortcuts but instead embraces a lifestyle centered around regular exercise and healthy habits. Whether she’s hitting the gym or practicing yoga, Bella stays committed to her routine, proving that slow and steady progress yields the best results.

Embracing Variety in Workouts

One of the secrets to Bella’s toned physique is her love for variety in workouts. From high-intensity interval training (HIIT) to Pilates and boxing, she keeps her exercise routine dynamic and engaging. By challenging her body in different ways, Bella ensures that she stays motivated and avoids plateaus, allowing her to continuously progress towards her fitness goals.

Mindful Eating for Optimal Health

In addition to her dedication to fitness, Bella Hadid emphasizes the importance of mindful eating for overall health and wellness. She follows a balanced diet rich in whole foods, prioritizing nutrient-dense meals while allowing herself the occasional indulgence. By fueling her body with the right foods, Bella ensures that she has the energy and stamina to power through her demanding schedule.

Setting Realistic Goals

While Bella Hadid’s physique may seem unattainable to some, she believes in setting realistic goals that are achievable with hard work and dedication. Rather than aiming for perfection, Bella focuses on progress, celebrating each milestone along the way. By setting attainable goals, she maintains a positive mindset and stays motivated to continue pushing herself to new heights.

The Importance of Rest and Recovery

Despite her busy schedule, Bella Hadid understands the importance of rest and recovery in achieving optimal fitness. She prioritizes sleep and relaxation, allowing her body to repair and recharge after intense workouts. By listening to her body’s cues and giving herself the time to rest, Bella ensures that she avoids burnout and stays in peak physical condition.

Inspiring Confidence and Empowerment

Beyond her physical transformation, Bella Hadid’s fitness journey serves as a source of inspiration for countless individuals around the world. By sharing her story openly and honestly, she empowers others to embrace their own fitness goals and prioritize their health and well-being. Bella’s message of self-love and acceptance resonates deeply, reminding us that true beauty comes from within.

Conclusion:

Bella Hadid’s journey to physical fitness is a testament to the power of dedication, consistency, and self-love. Through her commitment to regular exercise, mindful eating, and prioritizing rest and recovery, she has sculpted a physique that radiates strength and confidence. As we embark on our own fitness journeys, let us draw inspiration from Bella’s example and remember that with hard work and determination, anything is possible. Read more about bella hadid body

Balenciaga Campaign Controversy Unveiling the Scandal

Exploring the Balenciaga Campaign Scandal: Unraveling the Controversy

Introduction: The Fashion World Shaken

The fashion industry is no stranger to scandal, but few controversies have rocked the world of high fashion quite like the Balenciaga campaign scandal. In this article, we delve into the details of the controversy, examining its origins, impact, and implications for the fashion world at large.

The Genesis of the Scandal: Unveiling Offensive Imagery

The Balenciaga campaign scandal first came to light when images from the brand’s latest advertising campaign began circulating online. Critics were quick to point out the offensive nature of the imagery, which featured models in poses and settings that were widely considered to be insensitive and culturally inappropriate.

Social Media Backlash: Outrage and Criticism

As news of the scandal spread across social media platforms, a wave of outrage and criticism swept through the fashion community and beyond. Many users took to Twitter, Instagram, and other platforms to express their disgust with the campaign, calling out Balenciaga for perpetuating harmful stereotypes and engaging in cultural appropriation.

Brand Response: Damage Control and Apologies

In response to the backlash, Balenciaga issued a series of apologies and statements addressing the controversy. The brand acknowledged the offensive nature of the imagery and expressed regret for any harm caused. However, some critics argued that the apologies fell short of addressing the root causes of the scandal and failed to hold the brand accountable for its actions.

Industry Fallout: Repercussions for Balenciaga and Beyond

The Balenciaga campaign scandal had far-reaching implications for the fashion industry, sparking discussions about diversity, representation, and cultural sensitivity in advertising. Many critics called for greater accountability and transparency from brands, urging them to do better in their portrayal of marginalized communities.

Lessons Learned: Moving Forward with Integrity

In the wake of the scandal, many in the fashion industry have called for a reevaluation of advertising practices and a renewed commitment to diversity and inclusion. Brands like Balenciaga have an opportunity to learn from their mistakes and take concrete steps to ensure that their future campaigns are more respectful and inclusive.

The Power of Consumer Activism: Holding Brands Accountable

The Balenciaga campaign scandal serves as a powerful reminder of the influence that consumers wield in today’s digital age. Social media has given individuals a platform to hold brands accountable for their actions and demand change when necessary. Moving forward, consumers have the power to shape the fashion industry by supporting brands that align with their values and speaking out against those that do not.

Conclusion: A Call for Change

The Balenciaga campaign scandal may have been a dark moment for the fashion world, but it also serves as a catalyst for positive change. By confronting issues of diversity, representation, and cultural sensitivity head-on, brands like Balenciaga have an opportunity to rebuild trust with consumers and reaffirm their commitment to integrity and inclusivity. As the industry continues to evolve, let us hope that lessons learned from this scandal will pave the way for a more diverse, equitable, and socially responsible fashion landscape. Read more about balenciaga campaign scandal

Avril Lavigne’s Au Naturel Beauty Fresh-Faced Glow

Revealing the Authentic Avril Lavigne: No Makeup, Pure Charm

Introduction: The Unfiltered Beauty of Avril Lavigne

Avril Lavigne, the punk rock princess known for her edgy style and rebellious spirit, is not one to shy away from the spotlight. However, behind the glamorous facade lies a woman who is unafraid to embrace her natural beauty, flaws and all. In this article, we delve into the world of Avril Lavigne without makeup, celebrating her authenticity and confidence in her own skin.

Avril’s Makeup-Free Moments: A Glimpse Behind the Scenes

While Avril Lavigne is often seen rocking bold makeup looks on stage and on the red carpet, she is no stranger to going au naturel in her personal life. Whether she’s spending a quiet day at home or enjoying a casual outing with friends, Avril isn’t afraid to show off her bare face and let her natural beauty shine through. These makeup-free moments offer a rare glimpse into the real Avril – unfiltered, unapologetic, and effortlessly beautiful.

Embracing Natural Beauty: Avril’s Makeup Philosophy

For Avril Lavigne, makeup has always been about self-expression rather than concealment. While she enjoys experimenting with bold colors and edgy styles, she also understands the importance of embracing her natural beauty and letting her true self shine through. Whether she’s rocking a full face of makeup or going bare-faced, Avril’s confidence and authenticity are always front and center, inspiring fans around the world to embrace their own unique beauty.

Breaking the Beauty Mold: Avril’s Influence on Body Positivity

In a world where beauty standards are constantly evolving, Avril Lavigne stands out as a beacon of authenticity and self-acceptance. By proudly flaunting her makeup-free face and promoting body positivity, Avril has become a role model for women of all ages who struggle with self-esteem and body image issues. Her message is simple yet powerful: beauty comes in all shapes, sizes, and forms, and true beauty lies in embracing who you are, imperfections and all.

The Impact of Avril’s Makeup-Free Moments: Inspiring Confidence

Avril Lavigne’s makeup-free moments have had a profound impact on her fans, inspiring confidence and self-love in countless individuals around the world. By showing that it’s okay to be yourself, flaws and all, Avril has empowered her fans to embrace their natural beauty and love themselves for who they are. Whether she’s posting a bare-faced selfie on social media or stepping out without makeup in public, Avril’s authenticity and confidence serve as a powerful reminder that beauty is more than skin deep.

The Future of Beauty: A Shift Towards Authenticity

As society continues to evolve, there is a growing movement towards embracing authenticity and celebrating individuality in all its forms. Avril Lavigne’s makeup-free moments are a reflection of this shift, serving as a reminder that beauty is not defined by makeup or Photoshop, but by confidence, self-love, and authenticity. As more celebrities and influencers follow Avril’s lead and embrace their natural beauty, we can only hope that this trend towards authenticity will continue to grow, inspiring future generations to love themselves just the way they are. Read more about avril lavigne no makeup

Irresistible Charm Siren-Inspired Makeup Creations

Exploring the Enigmatic Allure of Siren Makeup

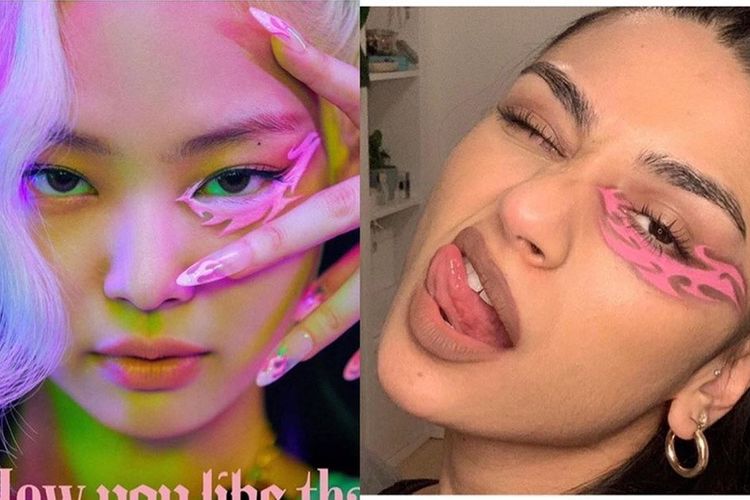

Siren Makeup: An Introduction

Siren makeup holds a timeless allure, captivating hearts with its seductive charm and enchanting beauty. Inspired by the mythical sirens of ancient lore, this makeup style exudes sensuality and mystique, making it a favorite choice for those who dare to embrace their inner temptress.

The Seductive Power of Siren Makeup

At the heart of siren makeup lies its undeniable power to captivate and allure. With its bold colors, sultry finishes, and daring techniques, siren makeup commands attention and leaves a lasting impression. From smoldering eyes to luscious lips, every element of siren makeup is designed to entice and enchant.

Mastering the Art of Siren Eyes

The eyes are the windows to the soul, and in siren makeup, they take center stage. With dark, smoky shadows, winged eyeliner, and dramatic lashes, siren eyes are both mesmerizing and mysterious. By mastering the art of siren eyes, one can instantly transform their look and exude confidence and allure.

Creating Luscious Siren Lips

No siren makeup look is complete without the perfect pout. Siren lips are bold, sultry, and impossible to ignore. From deep reds to vampy purples, the key to creating luscious siren lips lies in choosing the right shade and mastering the application technique. With a steady hand and a touch of confidence, anyone can unleash their inner temptress with a stunning siren lip.

Embracing Siren Skin: Flawless and Radiant

In siren makeup, flawless skin is essential. With a radiant complexion as the foundation, siren makeup looks come to life with a luminous glow that exudes health and vitality. From dewy foundations to shimmering highlighters, the key to achieving siren-worthy skin lies in embracing your natural beauty and enhancing it with strategic makeup techniques.

The Art of Siren Contouring and Highlighting

Contouring and highlighting are essential techniques in siren makeup, helping to sculpt and define the face for maximum impact. By strategically shading and highlighting the contours of the face, one can create a sculpted, chiseled look that enhances their natural features and adds depth and dimension to their overall appearance.

Accessorizing Siren Makeup: Adding the Finishing Touches

In siren makeup, the devil is in the details, and no look is complete without the perfect accessories. From statement jewelry to intricate headpieces, the key to accessorizing siren makeup lies in choosing pieces that complement and enhance the overall aesthetic. Whether it’s a sparkling tiara or a dramatic necklace, the right accessories can elevate a siren makeup look from stunning to unforgettable.

Unleashing Your Inner Siren: Confidence and Empowerment

Perhaps the most important aspect of siren makeup is the confidence and empowerment it inspires. By embracing the allure of siren makeup, one can tap into their inner strength and unleash their inner temptress with fearless abandon. With every stroke of the brush and every swipe of lipstick, siren makeup empowers individuals to embrace their unique beauty and express themselves with confidence and pride.

Conclusion

Siren makeup is more than just a beauty trend; it’s a statement of empowerment and self-expression. With its seductive charm and timeless allure, siren makeup invites individuals to embrace their inner temptress and unleash their true beauty upon the world. So go ahead, dare to dive deep into the enchanting world of siren makeup and discover the transformative power of seduction and allure. Read more about siren makeup